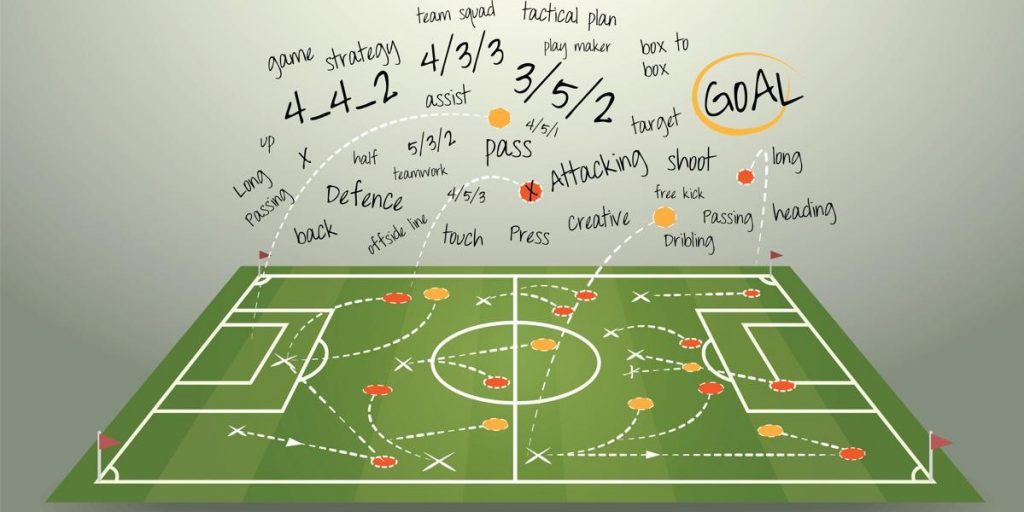

NFL trends will help you to make better bets by giving you a feel for the game. Football bettors who are savvy use trends to find value in games, especially when they wager on underdogs. This is crucial in primetime slots as the bettors might miss a game with a high-potential to ruin their bankroll.

You can use stats to help you place your bets. These numbers will help you to understand the performance of a team and which players have the biggest impact. They can also assist you in identifying weaknesses in a defence and help make better wagers on certain teams.

QB Ratings are allowed by opposing teams

Six out of eight Super Bowl champs were rated in the top ten in their opponent’s quarterback rating during the current season. This is a trend that has been growing over the past few years and it may be worth watching out for if you're looking to place your wagers on the next Super Bowl.

NFL referees call penalties

This can affect the pace of a game. Another referee might focus more on penalties for roughing the pass and defensive holding, while another may call fewer.

The Eagles, who are league leaders in the number of penalties called, may be a leading team but it's a bad sign when their offensive line is moving too early and without flags being thrown. The Eagles could be at a disadvantage if the trend continues. This was the case in the NFC Championship, which took place last weekend.

The spread of divisional rivalries is a trend that goes against the unders trend

The Raiders won 11 games in a row and are currently on a 7-0 SU streak when playing divisional rivals. However, they're on a 2-7 SU and ATS streak when facing rivals with a total under 50 points.

This is a fascinating trend. It suggests that the home field of a team can be an advantage when it comes totals. In fact, since 2012, "TNF" home teams have gone 69-47 SU and 58-52-6 ATS.

Trends and Totals for Monday Night Football Betting

Monday Night Football betting is popular during the NFL season. If you want to succeed, you must bet on trends. These trends tell you if or not you should bet on a particular game and how much.

These trends can prevent you from making bad bets. They can also help you make better weekly decisions. Keep an eye not only on these trends but the turnovers as well.

They are also a factor when a team is in a slump and has had a few poor performances in a row. It can also affect a team's performance if they are in a slump or have had a string of poor performances. The nfl's weekly turnover trends are important for this reason.

FAQ

What are the top side hustles that will make you money in 2022

You can make money by creating value for someone else. If you do this well, the money will follow.

Although you may not be aware of it, you have been creating value from day one. As a baby, your mother gave you life. Your life will be better if you learn to walk.

As long as you continue to give value to those around you, you'll keep making more. The truth is that the more you give, you will receive more.

Without even realizing it, value creation is a powerful force everyone uses every day. It doesn't matter if you're cooking dinner or driving your kids to school.

Today, Earth is home for nearly 7 million people. Each person is creating an amazing amount of value every day. Even if you created $1 worth of value an hour, that's $7 million a year.

It means that if there were ten ways to add $100 to the lives of someone every week, you'd make $700,000.000 extra per year. Imagine that you'd be earning more than you do now working full time.

Now, let's say you wanted to double that number. Let's assume you discovered 20 ways to make $200 more per month for someone. Not only would you earn another $14.4 million dollars annually, you'd also become incredibly wealthy.

Every day there are millions of opportunities for creating value. This includes selling ideas, products, or information.

Although our focus is often on income streams and careers, these are not the only things that matter. Ultimately, the real goal is to help others achieve theirs.

You can get ahead if you focus on creating value. You can get my free guide, "How to Create Value and Get Paid" here.

How much debt is too much?

There is no such thing as too much cash. You'll eventually run out cash if you spend more money than you earn. It takes time for savings growth to take place. Spend less if you're running low on cash.

But how much do you consider too much? Although there's no exact number that will work for everyone, it is a good rule to aim to live within 10%. You won't run out of money even after years spent saving.

This means that if you make $10,000 yearly, you shouldn't spend more than $1,000 monthly. Spend less than $2,000 per monthly if you earn $20,000 a year. If you earn $50,000, you should not spend more than $5,000 per calendar month.

This is where the key is to pay off all debts as quickly and easily as possible. This includes student loans, credit cards, car payments, and student loans. After these debts are paid, you will have more money to save.

It's best to think about whether you are going to invest any of the surplus income. If you decide to put your money toward stocks or bonds, you could lose money if the stock market falls. However, if you put your money into a savings account you can expect to see interest compound over time.

Let's take, for example, $100 per week that you have set aside to save. It would add up towards $500 over five-years. You'd have $1,000 saved by the end of six year. In eight years, you'd have nearly $3,000 in the bank. You'd have close to $13,000 saved by the time you hit ten years.

At the end of 15 years, you'll have nearly $40,000 in savings. This is quite remarkable. However, this amount would have earned you interest if it had been invested in stock market during the exact same period. Instead of $40,000 in savings, you would have more than 57,000.

It is important to know how to manage your money effectively. Otherwise, you might wind up with far more money than you planned.

What is the difference between passive income and active income?

Passive income can be defined as a way to make passive income without any work. Active income requires hard work and effort.

You create value for another person and earn active income. It is when someone buys a product or service you have created. Examples include creating a website, selling products online and writing an ebook.

Passive income is great because it allows you to focus on more important things while still making money. But most people aren't interested in working for themselves. People choose to work for passive income, and so they invest their time and effort.

Passive income isn't sustainable forever. You might run out of money if you don't generate passive income in the right time.

Also, you could burn out if passive income is not generated in a timely manner. It's better to get started now than later. You'll miss out on the best opportunities to maximize your earning potential if you wait to build passive income.

There are three types to passive income streams.

-

Business opportunities include opening a franchise, creating a blog or freelancer, as well as renting out property like real estate.

-

Investments - these include stocks and bonds, mutual funds, and ETFs

-

Real estate - This includes buying and flipping homes, renting properties, and investing in commercial real property.

How to build a passive income stream?

To make consistent earnings from one source you must first understand why people purchase what they do.

It means listening to their needs and desires. You need to know how to connect and sell to people.

The next step is how to convert leads and sales. To keep clients happy, you must be proficient in customer service.

Even though it may seem counterintuitive, every product or service has its buyer. If you know who this buyer is, your entire business can be built around him/her.

You have to put in a lot of effort to become millionaire. It takes even more to become billionaire. Why? It is because you have to first become a 1,000aire before you can become a millionaire.

Finally, you can become a millionaire. The final step is to become a millionaire. The same is true for becoming billionaire.

How can someone become a billionaire. It all starts with becoming a millionaire. All you need to do to achieve this is to start making money.

But before you can begin earning money, you have to get started. So let's talk about how to get started.

Why is personal finances important?

A key skill to any success is personal financial management. We live in a world that is fraught with money and often face difficult decisions regarding how we spend our hard-earned money.

So why should we wait to save money? What is the best thing to do with our time and energy?

The answer is yes and no. Yes, because most people feel guilty if they save money. It's not true, as more money means more opportunities to invest.

As long as you keep yourself focused on the bigger picture, you'll always be able to justify spending your money wisely.

Controlling your emotions is key to financial success. Focusing on the negative aspects in your life will make it difficult to think positive thoughts.

It is possible to have unrealistic expectations of how much you will accumulate. This is because you aren't able to manage your finances effectively.

These skills will allow you to move on to the next step: learning how to budget.

Budgeting means putting aside a portion every month for future expenses. Planning will allow you to avoid buying unnecessary items and provide sufficient funds to pay your bills.

Once you have mastered the art of allocating your resources efficiently, you can look forward towards a brighter financial tomorrow.

How can a beginner make passive income?

Start with the basics, learn how to create value for yourself, and then find ways to make money from that value.

You might even already have some ideas. If you do, great! But if you don't, start thinking about where you could add value and how you could turn those thoughts into action.

You can make money online by looking for opportunities that match you skills and interests.

For instance, if you enjoy creating websites or apps, there are lots of ways that you can generate revenue even while you sleep.

Reviewing products is a great way to express your creativity. Or if you're creative, you might consider designing logos or artwork for clients.

Whatever you decide to focus on, make sure you choose something that you enjoy. This will ensure that you stick with it for the long-term.

Once you have found a product/service that you enjoy selling, you will need to find a way to make it monetizable.

There are two main approaches to this. The first is to charge a flat-rate for your services (like freelancers) and the second is per project (like agencies).

In either case, once you've set your rates, you'll need to promote them. This means sharing them on social media, emailing your list, posting flyers, etc.

These three tips can help increase your chances to succeed when you promote your company:

-

Be a professional in all aspects of marketing. You never know who may be reading your content.

-

Know your subject matter before you speak. Fake experts are not appreciated.

-

Spam is not a good idea. You should avoid emailing anyone in your address list unless they have asked specifically for it. If someone asks for a recommendation, send it directly to them.

-

Use a good email service provider. Yahoo Mail or Gmail are both free.

-

Monitor your results. Track who opens your messages, clicks on links, and signs up for your mailing lists.

-

Measure your ROI - measure the number of leads generated by each campaign, and see which campaigns bring in the most conversions.

-

Ask your family and friends for feedback.

-

Different strategies can be tested - test them all to determine which one works best.

-

Learn new things - Keep learning to be a marketer.

Statistics

- U.S. stocks could rally another 25% now that Fed no longer has ‘back against the wall' in inflation fight (marketwatch.com)

- According to a June 2022 NerdWallet survey conducted online by The Harris Poll. (nerdwallet.com)

- These websites say they will pay you up to 92% of the card's value. (nerdwallet.com)

- 4 in 5 Americans (80%) say they put off financial decisions, and 35% of those delaying those decisions say it's because they feel overwhelmed at the thought of them. (nerdwallet.com)

- Shares of Six Flags Entertainment Corp. dove 4.7% in premarket trading Thursday, after the theme park operator reported third-quarter profit and r... (marketwatch.com)

External Links

How To

For cash flow improvement, passive income ideas

You don't have to work hard to make money online. Instead, there are ways for you to make passive income from home.

Perhaps you have an existing business which could benefit from automation. If you are thinking of starting a business, you might find that automating parts of your workflow can help you save time and increase productivity.

The more automated your company becomes, the more efficient you will see it become. This means you will be able to spend more time working on growing your business rather than running it.

Outsourcing tasks can be a great way to automate them. Outsourcing allows you and your company to concentrate on what is most important. By outsourcing a task you effectively delegate it to another party.

This means that you can focus on the important aspects of your business while allowing someone else to manage the details. Outsourcing allows you to focus on the important aspects of your business and not worry about the little things.

It is possible to make your hobby a side hustle. It's possible to earn extra cash by using your skills and talents to develop a product or service that is available online.

Articles are an example of this. You have many options for publishing your articles. These websites pay per article, allowing you to earn extra monthly cash.

Another option is to make videos. Many platforms allow you to upload videos to YouTube or Vimeo. You'll receive traffic to your website and social media pages when you post these videos.

Stocks and shares are another way to make some money. Stocks and shares are similar to real estate investments. You are instead paid rent. Instead, you receive dividends.

They are included in your dividend when shares you buy are purchased. The amount of dividend you receive depends on the stock you have.

If you decide to sell your shares, you will be able to reinvest the proceeds into new shares. In this way, you will continue to get paid dividends over time.