Sportsbooks offer many different kinds of betting options. Many of these bets can be placed on moneylines. This means that the odds are often variable. As such, the vig amount varies for different types of bets. You might think that a bet on an unfavored underdog has no vig but it is actually made up from another source.

Vigorish

Vigorish is the term for the fee that a bookmaker charges you for placing a bet. It can also be used for interest due to a loanshark. The word first entered English from Yiddish, a loanword from Ukrainian and Russian. It is now a common informal expression.

The word was originally not pronounced or spelled the same way today. The term was used before Webster's dictionary. It was used as a term for a payment to a bookseller. It was originally from Yiddish where the word "vignes" meant "vigors". It is thought to have been borrowed from the word vyigrysh, which means "gains".

Overround

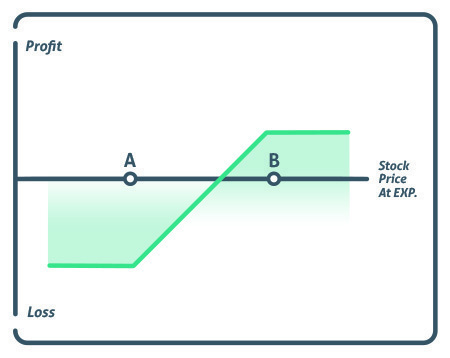

The overround vig, which sportsbooks charge on betting lines, is a hidden fee. It's a percentage of the implied probability total for both teams. If the Bucs are +300 to win the match, the overround would be 105 percent. This means that the betting line profits are just below the threshold and the implied probability total.

The overroundvig will vary from book-to-book. In some cases, bookmakers will add a higher margin than others. In other instances, a bookie might have a smaller margin. It is also known as the juice or vigorish.

Calculation of vigor

The vigorish calculation calculates the percentage of a wager that is lost. It is commonly calculated as proportional to the true odds. A "fair" line of betting would have odds of 2:1. This is a way to ensure that the bets are more balanced. Two people could agree to bet on the sporting event "evens". The stakes are split if one loses.

If a bet has an even money chance of winning, the vigorish calculation is calculated to maximize the winnings of both sides. For example, if a gambler has -110 odds and a bookmaker has 100, he would pay 110 for $100. In this instance, the loser is subject to the 'juiced’ odds and loses ten percent. In contrast, the winner receives back the 110 plus the profit of one hundred. As a result, the winner is still in front of the loser. He is still up one hundred dollars.

Vigorish percentage

What is the vigorish rate in sports betting? The vigorish percentage of a betting site's odds is the amount paid to a bettor. It can be either the winner or the loser. Sometimes, both. It is not easy to determine vigorish without knowing how a betor will behave. A variety of factors are involved in calculating the vigorish percentage. These include the quality and form of the odds and the team's home and away records.

Kelly gamblers want to increase his bankroll as quickly as possible so he wagers more when the payout is higher. If the vigorish is 20 percent, then he'll bet only half the amount he'd bet at fair odds.

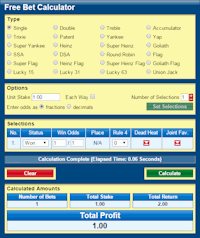

Calculating vig

Many sportsbooks also add a surcharge to bettors' winnings. It is a fee that the sportsbook keeps on every wager. In futures markets, the vig can be even larger than in regular markets because it is easier to hide. Knowing how to calculate vig can help you place bets in a better position.

Sportsbooks can also adjust the vig on certain sides of the bet. The win probability and wagered amount can influence the vig. You could win $87 if you wager $100 on Team A-7. However, $100 would have been wagered on the Team B +7.

FAQ

What is personal financing?

Personal finance is the art of managing your own finances to help you achieve your financial goals. This involves knowing where your money is going, what you can afford, as well as balancing your wants and needs.

You can become financially independent by mastering these skills. That means you no longer have to depend on anyone for financial support. You can forget about worrying about rent, utilities, or any other monthly bills.

It's not enough to learn how money management can help you make more money. It makes you happier. Feeling good about your finances will make you happier, more productive, and allow you to enjoy your life more.

What does personal finance matter to you? Everyone does! The most searched topic on the Internet is personal finance. Google Trends has shown that searches for personal finance have increased 1,600% from 2004 to 2014.

Today's smartphone users use their phones to compare prices, track budgets and build wealth. You can read blogs such as this one, view videos on YouTube about personal finances, and listen to podcasts that discuss investing.

According to Bankrate.com Americans spend on average four hours per day watching TV, listening and playing music, browsing the Internet, reading books, and talking to friends. This leaves just two hours per day for all other important activities.

Personal finance is something you can master.

How to build a passive stream of income?

To earn consistent earnings from the same source, it is important to understand why people make purchases.

Understanding their needs and wants is key. This requires you to be able connect with people and make sales to them.

The next step is to learn how to convert leads in to sales. Finally, you must master customer service so you can retain happy clients.

You may not realize this, but every product or service has a buyer. You can even design your entire business around that buyer if you know what they are.

You have to put in a lot of effort to become millionaire. It takes even more to become billionaire. Why? Why?

Then, you will need to become millionaire. You can also become a billionaire. The same goes for becoming a billionaire.

How does one become billionaire? It all starts with becoming a millionaire. You only need to begin making money in order to reach this goal.

But before you can begin earning money, you have to get started. Let's take a look at how we can get started.

Why is personal finance so important?

A key skill to any success is personal financial management. Our world is characterized by tight budgets and difficult decisions about how to spend it.

So why do we put off saving money? Is there something better to invest our time and effort on?

Yes and no. Yes, because most people feel guilty if they save money. Because the more money you earn the greater the opportunities to invest.

As long as you keep yourself focused on the bigger picture, you'll always be able to justify spending your money wisely.

To become financially successful, you need to learn to control your emotions. Focusing on the negative aspects in your life will make it difficult to think positive thoughts.

Your expectations regarding how much money you'll eventually accumulate may be unrealistic. This is because your financial management skills are not up to par.

Once you've mastered these skills, you'll be ready to tackle the next step - learning how to budget.

Budgeting means putting aside a portion every month for future expenses. You can plan ahead to avoid impulse purchases and have sufficient funds for your bills.

You now have the knowledge to efficiently allocate your resources and can start to see a brighter financial future.

What is the best way for a side business to make money?

If you want to make money quickly, it's not enough to create a product or a service that solves an individual's problem.

You need to be able to make yourself an authority in any niche you choose. It's important to have a strong online reputation.

Helping others solve problems is the best way to establish a reputation. Consider how you can bring value to the community.

Once you've answered that question, you'll immediately be able to figure out which areas you'd be most suited to tackle. There are countless ways to earn money online, and even though there are plenty of opportunities, they're often very competitive.

If you are careful, there are two main side hustles. One involves selling products directly to customers and the other is offering consulting services.

Each approach has its advantages and disadvantages. Selling services and products provides immediate gratification as you receive payment immediately after shipping your product or delivering your service.

The flip side is that you won't be able achieve the level you desire without building relationships and trust with potential clients. You will also find fierce competition for these gigs.

Consulting allows you to grow your business without worrying about shipping products or providing services. It takes more time to become an expert in your field.

You must learn to identify the right clients in order to be successful at each option. This requires a little bit of trial and error. But it will pay off big in the long term.

What are the top side hustles that will make you money in 2022

You can make money by creating value for someone else. If you do this well the money will follow.

Although you may not be aware of it, you have been creating value from day one. When you were little, you took your mommy's breastmilk and it gave you life. The best place to live was the one you created when you learned to walk.

You will always make more if your efforts are to be a positive influence on those around you. You'll actually get more if you give more.

Without even realizing it, value creation is a powerful force everyone uses every day. You create value every day, whether you are cooking for your family, driving your children to school, emptying the trash or just paying the bills.

In actuality, Earth is home to nearly 7 billion people right now. That's almost 7 billion people on Earth right now. This means that each person creates a remarkable amount of value every single day. Even if you only create $1 worth of value per hour, you'd be creating $7 million dollars a year.

If you could find ten more ways to make someone's week better, that's $700,000. Think about that - you would be earning far more than you currently do working full-time.

Now let's pretend you wanted that to be doubled. Let's say that you found 20 ways each month to add $200 to someone else's life. Not only would you earn another $14.4 million dollars annually, you'd also become incredibly wealthy.

Every day there are millions of opportunities for creating value. This includes selling information, products and services.

Although many of us spend our time thinking about careers and income streams, these tools are only tools that enable us to reach our goals. Helping others achieve theirs is the real goal.

If you want to get ahead, then focus on creating value. Start by downloading my free guide, How to Create Value and Get Paid for It.

How much debt can you take on?

It's essential to keep in mind that there is such a thing as too much money. If you spend more than you earn, you'll eventually run out of cash because it takes time for savings to grow. When you run out of money, reduce your spending.

But how much should you live with? There is no universal number. However, the rule of thumb is that you should live within 10%. This will ensure that you don't go bankrupt even after years of saving.

This means that even if you make $10,000 per year, you should not spend more then $1,000 each month. If you make $20,000, you should' t spend more than $2,000 per month. For $50,000 you can spend no more than $5,000 each month.

This is where the key is to pay off all debts as quickly and easily as possible. This includes student loans, credit card debts, car payments, and credit card bill. When these are paid off you'll have money left to save.

You should also consider whether you would like to invest any surplus income. If you decide to put your money toward stocks or bonds, you could lose money if the stock market falls. However, if the money is put into savings accounts, it will compound over time.

As an example, suppose you save $100 each week. In five years, this would add up to $500. You'd have $1,000 saved by the end of six year. In eight years you would have almost $3,000 saved in the bank. It would take you close to $13,000 to save by the time that you reach ten.

At the end of 15 years, you'll have nearly $40,000 in savings. It's impressive. However, this amount would have earned you interest if it had been invested in stock market during the exact same period. Instead of $40,000 you would now have $57,000.

You need to be able to manage your finances well. Otherwise, you might wind up with far more money than you planned.

Statistics

- As mortgage rates dip below 7%, ‘millennials should jump at a 6% mortgage like bears grabbing for honey' New homeowners and renters bear the brunt of October inflation — they're cutting back on eating out, entertainment and vacations to beat rising costs (marketwatch.com)

- U.S. stocks could rally another 25% now that Fed no longer has ‘back against the wall' in inflation fight (marketwatch.com)

- Etsy boasted about 96 million active buyers and grossed over $13.5 billion in merchandise sales in 2021, according to data from Statista. (nerdwallet.com)

- Mortgage rates hit 7.08%, Freddie Mac says Most Popular (marketwatch.com)

- According to a June 2022 NerdWallet survey conducted online by The Harris Poll. (nerdwallet.com)

External Links

How To

How to Make Money online

It is much easier to make money online than it was 10 years ago. You have to change the way you invest your money. Although there are many options for passive income, not all require large upfront investments. Some methods are easier than other. You should be aware of these things if you are serious about making money online.

-

Find out what kind of investor you are. PTC sites (Pay Per Click) are great for those who want to quickly make a quick buck. They pay you to simply click ads. You might also consider affiliate marketing opportunities if your goal is to make long-term money.

-

Do your research. Before you commit to any program, you must do your homework. Check out past performance records and testimonials before you commit to any program. It is not worth wasting your time and effort only to find out that the product does not work.

-

Start small. Do not rush to tackle a huge project. Instead, you should start by building something small. This will enable you to get the basics down and make a decision about whether or not this type of business is for your. When you feel confident, expand your efforts and take on bigger projects.

-

Get started now! You don't have to wait too long to start making money online. Even if you have been working full-time for years you still have time to build a strong portfolio of niche websites. You just need a good idea, and some determination. Take action now!