A punter is an American football special team player who kicks the soccer ball directly to the opponent's team, thus limiting the advantage in field position. This happens most often on a 4th down in American and 3rd down in Canadian football. But it can happen when a team is about to lose possession of the ball.

Punters typically have a background as kickers or placekickers, and they are experienced in catching balls that are long snapped. They have an extensive knowledge of kicking techniques and how to react in case a field goals attempt is missed.

The can be a very important part of any offense. By limiting the time it takes for opponents to gain control, they can stop them from scoring. In addition, they can be used as a decoy to allow the kicker to run the ball.

The word "punter", can refer to many different people. For example, it could be used for a professional gambler, con man, person who pays something, client of a prostitute or customer of an unlicensed business.

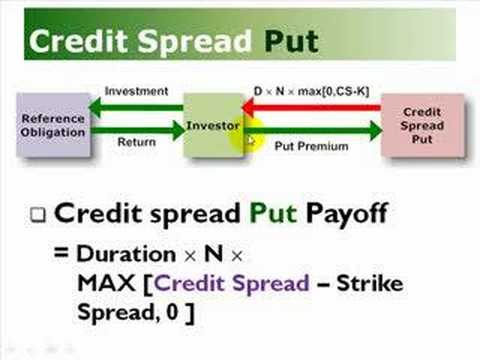

A punter can also be a person who is a speculator in the financial markets, usually a trader or investor. This is a potentially risky and unlikely thing to do. However, it often has lucrative rewards.

Punters are those who make money by taking big risks. Punters are known to take on a lot of risk and use a large amount of leverage.

Forex is one of the biggest markets in the entire world, and it's open 24 hours per day. They can make huge amounts of money quickly depending on the direction of the forex market.

British slang

In the UK, the word "punter" can be used for a number of different people. It can be used for a number of different people in the UK.

This group of people is confident that they can win. They often make bets based on gut feelings or their herd mentality, and they are confident that they can get the best possible return for their money.

The earliest sense of the word "punter" in English is probably from French ponte and ponter, meaning a punter who played against the bank in baccarat or other card games. This word may have come from Spanish punto meaning a punter that played cards.

The modern sense of the word is generally a slang term for a gambler or a con man's mark. It's usually seen as dismissive and unfriendly, and it can be offensive to the person you use it for.

FAQ

Which side hustles have the highest potential to be profitable?

Side hustle is a term used to describe any side income streams that can supplement your main source.

Side hustles are very important because they provide extra money for bills and fun activities.

Side hustles not only help you save money for retirement but also give you flexibility and can increase your earning potential.

There are two types. Online side hustles can be passive or active. These include ecommerce shops, blogging and freelancing. Some of the active side hustles are tutoring, dog walking and selling eBay items.

Side hustles that are right for you fit in your daily life. Start a fitness company if you are passionate about working out. You might consider working as a freelance landscaper if you love spending time outdoors.

Side hustles are available anywhere. Look for opportunities where you already spend time -- whether it's volunteering or taking classes.

You might open your own design studio if you are skilled in graphic design. Perhaps you're an experienced writer so why not go ghostwriting?

Whatever side hustle you choose, be sure to do thorough research and planning ahead of time. This way, when the opportunity arises, you'll be ready to jump right in and take advantage of it.

Side hustles don't have to be about making money. Side hustles can be about creating wealth or freedom.

There are so many opportunities to make money that you don't have to give up, so why not get one?

How much debt is considered excessive?

It's essential to keep in mind that there is such a thing as too much money. You'll eventually run out cash if you spend more money than you earn. It takes time for savings growth to take place. You should cut back on spending if you feel you have run out of cash.

But how much is too much? While there is no one right answer, the general rule of thumb is to live within 10% your income. You won't run out of money even after years spent saving.

This means that even if you make $10,000 per year, you should not spend more then $1,000 each month. You should not spend more than $2,000 a month if you have $20,000 in annual income. And if you make $50,000, you shouldn't spend more than $5,000 per month.

This is where the key is to pay off all debts as quickly and easily as possible. This includes student loans, credit card debts, car payments, and credit card bill. You'll be able to save more money once these are paid off.

You should consider where you plan to put your excess income. You could lose your money if you invest in stocks or bonds. You can still expect interest to accrue if your money is saved.

Consider, for example: $100 per week is a savings goal. It would add up towards $500 over five-years. At the end of six years, you'd have $1,000 saved. In eight years, your savings would be close to $3,000 When you turn ten, you will have almost $13,000 in savings.

Your savings account will be nearly $40,000 by the end 15 years. That's quite impressive. But if you had put the same amount into the stock market over the same time period, you would have earned interest. You'd have more than $57,000 instead of $40,000

That's why it's important to learn how to manage your finances wisely. You might end up with more money than you expected.

How can rich people earn passive income?

If you're trying to create money online, there are two ways to go about it. The first is to create great products or services that people love and will pay for. This is what we call "earning money".

The second is to find a method to give value to others while not spending too much time creating products. This is called "passive" income.

Let's suppose you have an app company. Your job is developing apps. You decide to make them available for free, instead of selling them to users. It's a great model, as it doesn't depend on users paying. Instead, you rely on advertising revenue.

To sustain yourself while you're building your company, you might also charge customers monthly fees.

This is how internet entrepreneurs who are successful today make their money. Instead of making money, they are focused on providing value to others.

What are the most profitable side hustles in 2022?

The best way to make money today is to create value for someone else. If you do this well the money will follow.

Even though you may not realise it right now, you have been creating value since the beginning. As a baby, your mother gave you life. You made your life easier by learning to walk.

You'll continue to make more if you give back to the people around you. You'll actually get more if you give more.

Everyone uses value creation every day, even though they don't know it. You create value every day, whether you are cooking for your family, driving your children to school, emptying the trash or just paying the bills.

In fact, there are nearly 7 billion people on Earth right now. This means that every person creates a tremendous amount of value each day. Even if your hourly value is $1, you could create $7 million annually.

That means that if you could find ten ways to add $100 to someone's life per week, you'd earn an extra $700,000 a year. Think about that - you would be earning far more than you currently do working full-time.

Now, let's say you wanted to double that number. Let's say you found 20 ways to add $200 to someone's life per month. You'd not only earn an additional $14.4 million annually but also be incredibly rich.

Every day offers millions of opportunities to add value. This includes selling products, services, ideas, and information.

Although we tend to spend a lot of time focusing on our careers and income streams, they are just tools that allow us to achieve our goals. The ultimate goal is to assist others in achieving theirs.

To get ahead, you must create value. Use my guide How to create value and get paid for it.

What is personal finances?

Personal finance involves managing your money to meet your goals at work or home. It involves understanding where your money goes, knowing what you can afford, and balancing your needs against your wants.

These skills will allow you to become financially independent. This means that you won't have to rely on others for your financial needs. You don't need to worry about monthly rent and utility bills.

And learning how to manage your money doesn't just help you get ahead. It makes you happier. If you are happy with your finances, you will be less stressed and more likely to get promoted quickly.

What does personal finance matter to you? Everyone does! Personal finance is the most popular topic on the Internet. Google Trends indicates that search terms for "personal finance” have seen a 1,600% increase in searches between 2004-2014.

People today use their smartphones to track their budgets, compare prices, build wealth, and more. They read blogs like this one, watch videos about personal finance on YouTube, and listen to podcasts about investing.

Bankrate.com estimates that Americans spend on average 4 hours per day viewing TV, listening to music and playing video games, as well reading books and talking with friends. It leaves just two hours each day to do everything else important.

Personal finance is something you can master.

Why is personal financing important?

Personal financial management is an essential skill for anyone who wants to succeed. We live in a world with tight finances and must make tough decisions about how we spend our hard earned cash.

Why then do we keep putting off saving money. Is there something better to invest our time and effort on?

Yes, and no. Yes, most people feel guilty saving money. Yes, but the more you make, the more you can invest.

If you can keep your eyes on what is bigger, you will always be able spend your money wisely.

Financial success requires you to manage your emotions. If you are focusing on the negative aspects of your life, you will not have positive thoughts that can support you.

Unrealistic expectations may also be a factor in how much you will end up with. You don't know how to properly manage your finances.

After mastering these skills, it's time to learn how to budget.

Budgeting refers to the practice of setting aside a portion each month for future expenses. Planning will help you avoid unnecessary purchases and make sure you have enough money to pay your bills.

You now have the knowledge to efficiently allocate your resources and can start to see a brighter financial future.

Statistics

- While 39% of Americans say they feel anxious when making financial decisions, according to the survey, 30% feel confident and 17% excited, suggesting it is possible to feel good when navigating your finances. (nerdwallet.com)

- According to the company's website, people often earn $25 to $45 daily. (nerdwallet.com)

- According to a June 2022 NerdWallet survey conducted online by The Harris Poll. (nerdwallet.com)

- Shares of Six Flags Entertainment Corp. dove 4.7% in premarket trading Thursday, after the theme park operator reported third-quarter profit and r... (marketwatch.com)

- Etsy boasted about 96 million active buyers and grossed over $13.5 billion in merchandise sales in 2021, according to data from Statista. (nerdwallet.com)

External Links

How To

How to make money even if you are asleep

You must be able to fall asleep while you're awake if you want to make it big online. This means that you must be able to do more than simply wait for someone click on your link to buy your product. It is possible to make money while you are sleeping.

You must be able to build an automated system that can make money without you even having to move a finger. To do that, you must master the art of automation.

It would be a great help to become an expert in building software systems that automate tasks. This will allow you to focus on your business while you sleep. You can even automate yourself out of a job.

It is best to keep a running list of the problems you face each day to help you find these opportunities. Ask yourself if you can automate these problems.

Once you've done that, you'll probably realize that you already have dozens of potential ways to generate passive income. Now, you have to figure out which would be most profitable.

You could, for example, create a website builder that automates creating websites if you are webmaster. Maybe you are a webmaster and a graphic designer. You could also create templates that could be used to automate production of logos.

If you have a business, you might be able to create software that allows you manage multiple clients simultaneously. There are hundreds of possibilities.

As long as you can come up with a creative idea that solves a problem, you can automate it. Automation is key to financial freedom.